The most widely used NLP for Finance

As with last year’s survey, Spark NLP is the most popular library for production use

Proven Success across Finance

Vakilsearch Understands Scanned Legal & Tax Forms Using John Snow Labs

A unified CV, OCR, and NLP approach for scalable document understanding at DocuSign

Spark NLP in action: intelligent, high-accuracy fact extraction from long financial documents

Accelerating clinical risk adjustment through Natural Language Processing

Text Classification into a Hierarchical Market Taxonomy using Spark NLP at Bitvore

ESG Document Classification

What’s in the Box

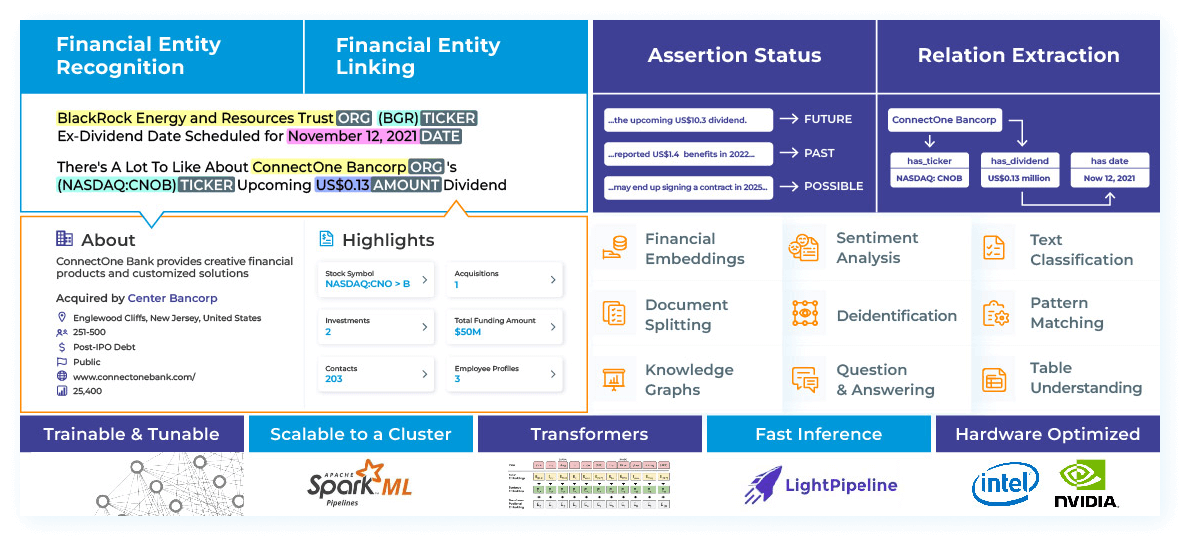

Finance NLP in Action

Extract Organizations, People, Locations, and many other entities from long, free-text financial documents.

Automatically identify relationships between companies, products, and people – even when they are mentioned using aliases.

Enrich extracted company names with additional NASDAQ information.

Classify texts into 77 banking-related categories like credit reports, mortgages, money transfers and more.

Identify positive, negative or neutral sentiments in financial news.

De-identify and mask sensitive personal information in documents and images.

Finance NLP includes Zero-shot Table Understanding. Ask questions to your tables using Natural Language and get answers to them.

Get Started with NLP for Finance

Frequently Asked Questions

1. Enhanced Efficiency. NLP's prowess lies in its ability to swiftly process vast quantities of unstructured data, swiftly transforming it into valuable real-time insights. Whether dealing with reports, articles, or financial documents, NLP streamlines the extraction of pertinent information, reducing manual effort and expediting decision-making processes.

2. Unmatched Consistency. In a realm where precise analysis is paramount, NLP shines by delivering consistent interpretations across a spectrum of financial texts. Unlike human analysts, NLP models don't vary in their comprehension, ensuring that nuances within the financial language are consistently deciphered without the risk of subjectivity.

3. Elevated Accuracy. The enormity of financial documents can sometimes lead to human oversight or misinterpretation. NLP mitigates such discrepancies by comprehensively processing data, leaving minimal room for errors. This precision is particularly crucial in financial contexts where even minor inaccuracies can lead to significant consequences.

4. Seamless Scaling. NLP's scalability is a game-changer. Whether it's scrutinizing internal reports, emails, social media chatter, or other textual data, NLP-driven analysis operates at remarkable speed. Tedious tasks that would normally span days or weeks can now be accomplished within seconds or minutes, empowering financial experts to focus on strategic insights rather than routine data processing.

5. Empowering Process Automation. Imagine automating the entire cycle of sifting through intricate financial documents and deriving actionable insights. NLP technology makes this a reality by autonomously extracting valuable information from financial texts, significantly reducing the time and effort required for manual analysis.

Leveraging the power of NLP for financial documents offers a strategic edge in the ever-evolving world of finance. Seamlessly merging technology and financial expertise, Finance NLP extracts invaluable insights from the labyrinth of financial documents. Here's how this synergy works:

1. Efficient Data Extraction. NLP for financial documents employs advanced algorithms to swiftly extract pertinent data from a diverse range of textual formats. From annual reports to market analyses, NLP technology effortlessly identifies and captures crucial information, minimizing manual effort and expediting data compilation.

2. Sentiment Analysis. In the financial realm, understanding market sentiment is pivotal. NLP tools enable sentiment analysis of news articles, press releases, and social media conversations, providing data scientists with a real-time pulse of market sentiment. This insight aids in making informed investment decisions and anticipating market shifts.

3. Risk Assessment. NLP-driven risk assessment is a game-changer for financial services. By analyzing reports, balance sheets, and regulatory documents, Finance NLP identifies potential risks, helping institutions navigate complex risk landscapes with greater accuracy.

4. Trend Identification. Python NLP for financial documents empowers data scientists to uncover trends hidden within vast volumes of data. By processing historical data and news, NLP technology detects patterns, enabling professionals to predict market movements and identify emerging opportunities.

5. Regulatory Compliance. Navigating financial regulations is a paramount concern. NLP for financial documents aids in automated compliance checks by extracting relevant information from legal texts and policy documents, ensuring adherence to intricate regulatory frameworks.

6. Client Insights. Understanding client needs is essential for financial services. NLP analyzes client interactions, emails, and feedback to derive insights, assisting in personalized services and improved client satisfaction.

7. Automated Reporting. Manual report generation can be time-consuming. Finance NLP automates this process by extracting data and generating summaries from financial documents, freeing up valuable time for data scientists to focus on strategic analysis.

Financial NLP s a transformative technology that holds the potential to significantly enhance operational efficiency within the finance industry. By harnessing the power of linguistic analysis and advanced algorithms, Financial NLP offers a range of advantages that optimize processes and streamline workflows. Here's how Financial NLP improves operational efficiency:

1. Automated Data Handling. By embracing NLP for automated data handling, financial institutions can optimize their operational processes, enhance data accuracy, and redirect human efforts towards more strategic tasks. NLP empowers automated data handling in finance with Data Extraction from Unstructured Sources, Rapid Information Retrieval, Language Interpretation, Data Categorization and Summarization, Pattern Recognition, Scalable Processing, Customizable Workflows, Error Reduction, and Efficient data integration.

2. Real-time Insights. Financial NLP swiftly processes a multitude of sources including news articles, market reports, and social media data to extract relevant information. This empowers data scientists with up-to-date market trends, enabling them to make informed decisions promptly.

3. Risk Management. Financial NLP aids in analyzing historical data, regulatory documents, and market sentiment to identify potential risks. By detecting patterns and anomalies, it enables institutions to proactively manage risks and make strategic adjustments.

4. Optimized Customer Experience. Financial NLP goes beyond data analysis; it delves into customer interactions, feedback, and inquiries to generate insights into customer preferences and sentiments. This understanding enables institutions to tailor their services, leading to enhanced customer satisfaction and loyalty.

5. Effortless Compliance. Financial NLP automates the extraction of relevant information from legal texts, assisting institutions in adhering to evolving regulatory frameworks without manual scrutiny.

6. Accelerated Reporting. Financial NLP expedites comprehensive reports by extracting key information from financial documents and generating concise summaries. It reduces the reporting timeline and enhances the accuracy of the generated reports.

7. Informed Decision-Making. Empowered by Financial NLP's insights derived from extensive data, data scientists can identify trends, analyze historical patterns, and forecast market movements. This data-driven decision-making approach contributes to overall company success.

Here's how Finance NLP proves to be a valuable asset for banking and financial services:

Finance NLP enables banks and financial institutions to engage with customers on a whole new level. By analyzing customer interactions, feedback, and banking inquiries, NLP technology generates insights into customer preferences and sentiments. This understanding empowers banking institutions to offer personalized services and solutions, fostering stronger client relationships.

Staying informed about market trends is critical in the financial world. Finance NLP processes news articles, reports, and social media data in real-time to extract relevant insights. This empowers banking professionals to make well-informed investment decisions, keeping clients' portfolios aligned with ever-changing market dynamics.

Identifying and managing risks is a cornerstone of banking services. Finance NLP delves into historical data, regulatory documents, and market sentiment to identify potential risks. By uncovering patterns and anomalies, NLP assists banking institutions in proactively managing risks.

Navigating the complex landscape of financial regulations demands rigorous compliance checks. Finance NLP automates the extraction of relevant information from legal texts and policy documents, enabling banking institutions to ensure adherence to regulatory guidelines without the burden of manual scrutiny.

Data is at the heart of financial services. Finance NLP enables data scientists in the banking industry to analyze vast datasets, recognize trends, and predict market movements. This data-driven approach enhances decision-making accuracy, allowing banking institutions to seize opportunities and mitigate risks effectively.

Financial institutions handle a myriad of documents daily. Finance NLP automates the processing of extracting key information and generating summaries from financial documents. This accelerates workflows, reduces manual effort, and enhances overall operational efficiency in banking.

Finance NLP solutions can be tailored to the unique needs of each banking institution. Customization ensures that the technology addresses specific challenges, from client communication analysis to fraud detection and beyond.

In a competitive landscape, staying ahead is crucial. Finance NLP empowers banking institutions to harness insights from diverse data sources, enabling them to offer innovative services, anticipate market shifts, and meet evolving client expectations.